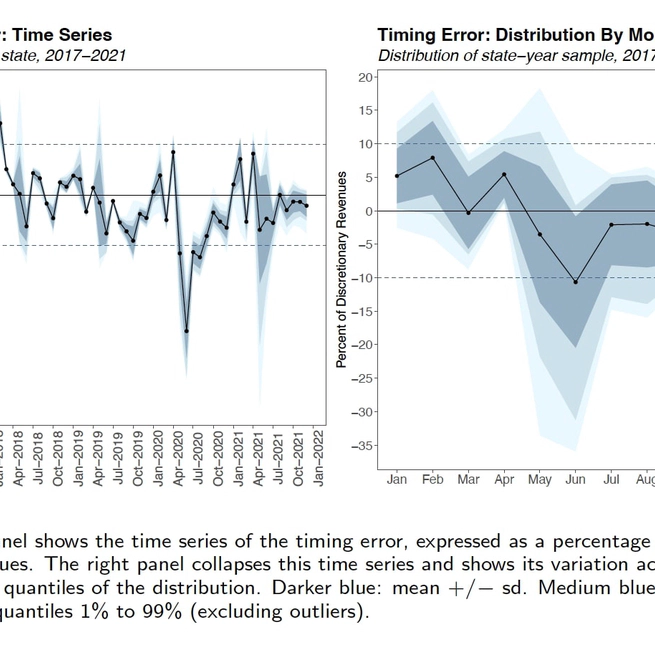

Governments ensure uninterrupted service delivery with timely payments on operating expenses by maintaining sufficient cash reserves and/or resorting to short-term borrowing. A theoretical model of cash-flow management shows that the precautionary role of cash reserves shapes the liquidity constraints experienced by low-capitalized governments.

Aug 19, 2024

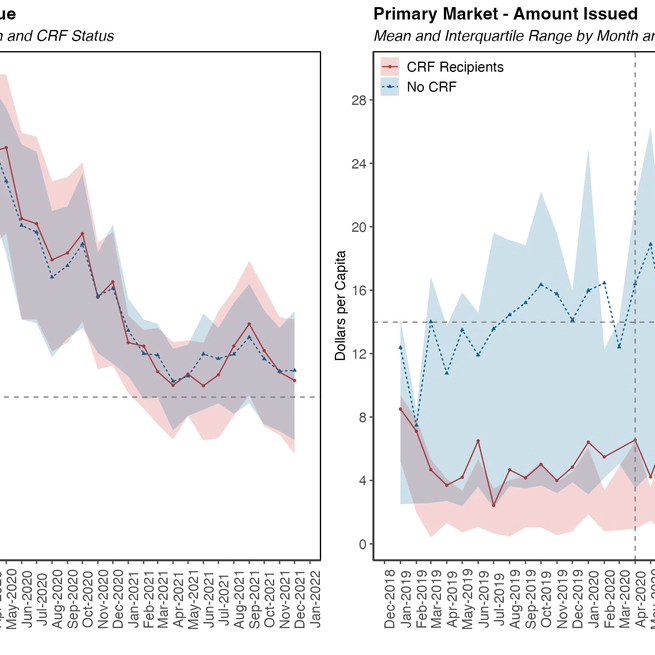

Access to cash can affect the ability of local governments to respond to crises. Federal aid to local governments can supply this directly, though the effectiveness on a dollar-per-dollar basis depends on its complementary or substitutability with local borrowing. Through this lens this examines the effects of the Coronavirus Relief Fund (CRF) on the local governments borrowing using a regression discontinuity design that exploits the quasi-experimental setting induced by the fund eligibility criterion imposed by the US Treasury.

Aug 1, 2024

Federal grants represent one of the main sources of revenues for state governments and, hence, shape the way states conduct their fiscal policy. While literature on fiscal federalism and the flypaper effect had extensively studied how grants influence subnational spending, there is relatively few evidence on the responsiveness of state tax decisions to changes on intergovernmental revenues.

May 10, 2024